Mustafa Kürşat Yalçın

7 Min Read

When data is siloed and reports are fragmented, law firms risk delays, missed opportunities, and lost clients. A unified data approach with real-time insights enables smarter decisions and sustainable success. Let’s change that fate!

Introduction

We all know running a law firm isn’t always straightforward. Sometimes data flows smoothly, guiding decisions effortlessly; other times, it feels like you’re juggling pieces that don’t quite fit. Recently, the 2023 American Bar Association Legal Technology Survey revealed something striking: over 65% of law firms struggle to integrate data across different systems, leading to delays and errors in reporting. This fragmentation isn’t just a minor inconvenience — it affects profitability, client satisfaction, and the ability to compete.

Yet, many firms still rely on disconnected platforms and manual spreadsheets, burning hours on tedious reporting tasks while lacking a clear, real-time picture of their business. How can mid-sized law firms change that? How can they turn these scattered pieces into a powerful, strategic asset?

Welcome to our latest blog post — where we explore how integrated data systems and smart analytics are reshaping law firms' operations!

The Hidden Cost of Data Fragmentation in Law Firms

You’ve probably been there: trying to pull together reports from multiple platforms — your CRM, billing software, accounting tools — only to find the data doesn’t align, or the process takes hours every month. It’s frustrating, and worse, it creates blind spots for your leadership.

A 2023 ABA survey highlights this pain: more than half of law firms cite poor data integration as their top technology challenge. This results in lost productivity, delayed insights, and decisions made on incomplete or outdated data.

When your team spends too much time on manual data wrangling, it leaves less room for strategic thinking. Plus, when leadership can’t see accurate metrics in real-time — like how many new clients converted this month or which attorneys are billing efficiently — the firm risks missing opportunities and falling behind competitors.

This isn’t just a tech problem; it’s a business problem.

Why a Centralized Data Warehouse is a Game Changer

Imagine a place where all your critical data lives in harmony — your client info, billing details, and financials flowing seamlessly into one centralized system. This isn’t just wishful thinking; it’s what a data warehouse does.

A data warehouse acts as the backbone of a firm’s data ecosystem by consolidating information from multiple, often incompatible sources into a single, organized repository. Instead of the constant back-and-forth of exporting and importing data between platforms, the data warehouse automates this process, ensuring that your information is clean, consistent, and ready for analysis at any time.

For law firms, this means gaining a holistic, end-to-end view of the business. Whether it’s tracking a client from their initial inquiry, through consultations, case progress, billing, and payments, all relevant data lives in one place. This centralization eliminates guesswork and enables firm leaders to better understand patterns and relationships across different functions.

Without such a system, data remains trapped in silos — each department working with partial information, which limits collaboration and strategic insight. A centralized data warehouse fosters transparency and alignment by making critical information accessible across teams, which is especially important for firms managing complex caseloads or multiple offices.

Ultimately, the data warehouse sets the stage for smarter decision-making, greater operational coordination, and long-term scalability, transforming how a law firm approaches growth and efficiency.

Unlocking Business Insights: The KPIs That Matter Most

Data is powerful — but only when it focuses on the right questions. For law firms, knowing which KPIs to track can make all the difference between navigating blindly and steering with confidence.

Take client leads, for example. It’s not enough to know how many inquiries come in; the critical piece is understanding how many of those leads truly qualify as potential clients. By distinguishing qualified leads — those that fit the firm’s financial and case complexity thresholds — from general inquiries, firms can sharpen their marketing focus and intake strategies, improving efficiency.

Conversion rates are another key insight: how many qualified leads book consultations, and how many of those convert to retained clients? Tracking these funnel metrics helps identify strengths and bottlenecks in client acquisition processes, guiding adjustments that can increase revenue.

On the operations side, measuring billable hours per attorney and comparing salaried versus variable pay arrangements offers insight into productivity and resource utilization. Are the most experienced attorneys billing enough to justify their compensation? Are newer staff on track to meet targets? These metrics help firms balance workloads and optimize staffing.

When law firms focus on these KPIs, they move beyond activity tracking to measuring what truly impacts growth and profitability — building a foundation for strategic, data-driven management.

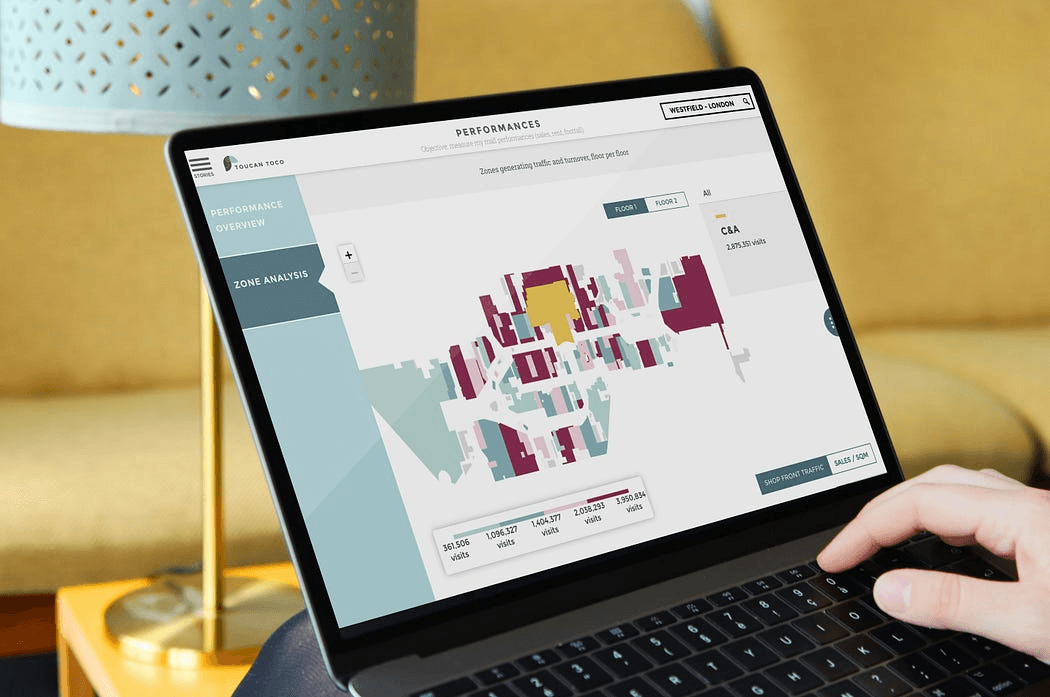

Bringing Data to Life with Interactive Dashboards

Static spreadsheets have long been the default for many firms’ reporting needs, but their limitations are clear: they’re slow to update, difficult to explore dynamically, and prone to error.

Interactive dashboards change the game by turning complex data into vivid, intuitive visualizations that anyone in the firm can understand and use. With tools like Power BI, a managing partner can instantly filter data by timeframe, practice area, or attorney to uncover meaningful insights that might have taken hours to piece together manually.

The ability to interact with data — zooming into specific metrics, comparing trends side-by-side, or highlighting outliers — makes decision-making faster and more confident. Teams can spot emerging patterns, identify potential issues early, and validate the impact of strategic initiatives.

Moreover, these dashboards can be tailored to different users’ needs. Attorneys can focus on their individual caseloads and billing performance, intake teams can monitor lead flow and conversion rates, while finance teams can track revenue and expenses — all within the same system but with customized views.

This level of transparency and agility encourages a culture of data-driven decision-making, where facts — not assumptions — guide the firm’s direction. Over time, this leads to improved operational alignment, more effective resource allocation, and ultimately, stronger financial results.

The People Side: Why Training Completes the Transformation

Technology isn’t magic. Its true power comes alive when your team knows how to use it.

Investing in data literacy training helps staff move from data consumers to data champions. Training demystifies dashboards and KPIs, boosting confidence and adoption.

Firms that invest in this kind of training often see a significant increase in the use of business intelligence tools, which leads to faster realization of value and greater returns on their technology investments.

When intake specialists, attorneys, and leadership all speak the same data language, the firm gains agility and alignment. This shared understanding fosters better collaboration and speeds up decision-making, creating a culture where data supports every strategic move.

See real-life action: What Our Law Firm Client Achieved In 6 Weeks (by May 2025)

Let’s look at a real example. Our mid-sized law client faced many of these challenges: disconnected systems, slow reporting, and leadership struggling to track leads and revenue in real-time.

We stepped in and mapped out the existing technology landscape. We designed a scalable SQL data warehouse to bring client, billing, and accounting data together. Custom connectors automated data integration, eliminating manual CSV exports.

With tailored Power BI dashboards and team training, our client saw impressive results just six weeks after implementation:

37% reduction in reporting time

16% increase in lead-to-client conversion visibility

12% increase in attorney billable hours utilization

15% decrease in client write-offs

Conclusion: Business Intelligence Is the Future of Law Firm Success

When data is siloed and reports are fragmented, law firms risk delays, missed opportunities, and lost clients. A unified data approach with real-time insights enables smarter decisions and sustainable success. Let’s change that fate!